In the realm of Australian taxation, personal services income (PSI) stands as a critical concept, influencing how individuals and businesses report and manage their earnings. In this comprehensive guide, we’ll delve into the intricacies of PSI, exploring its definition, implications, and the key factors individuals need to consider.

What is Personal Services Income (PSI)?

Personal Services Income, commonly known as PSI, refers to income generated mainly from an individual’s skills, efforts, or expertise. This type of income typically arises when a person directly performs services for a client or engages in a contractual arrangement where the income is a reward for their personal efforts.

A Time and Materials (T+M) contract, especially if you submit a timesheet, for your professional services (e.g. engineering, consulting, trades) is an example.

Identifying PSI

Determining whether income falls under the PSI category involves assessing various factors.

The Australian Taxation Office (ATO) emphasizes the following key indicators:

- Personal Service Relationship: PSI often arises when there’s a direct connection between the individual providing the service and the client.

- Results Test: If the individual is paid for achieving a specific result rather than for the time worked, it might be considered business income rather than PSI.

- Unrelated Clients Test: This test examines whether the individual provides services to multiple clients simultaneously, reducing the dependence on a single source of income.

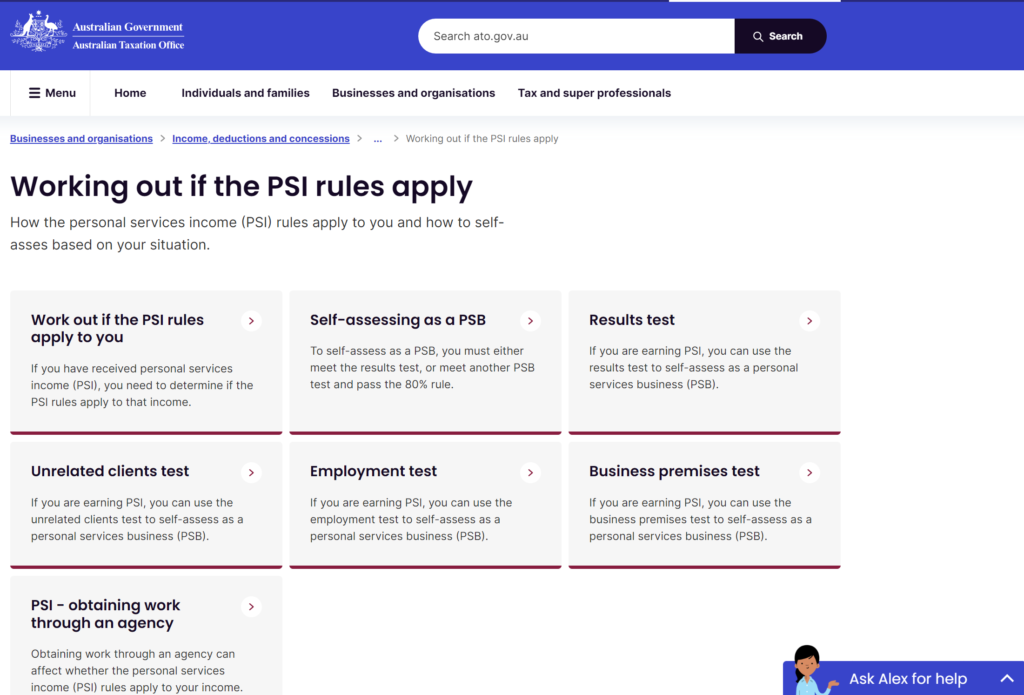

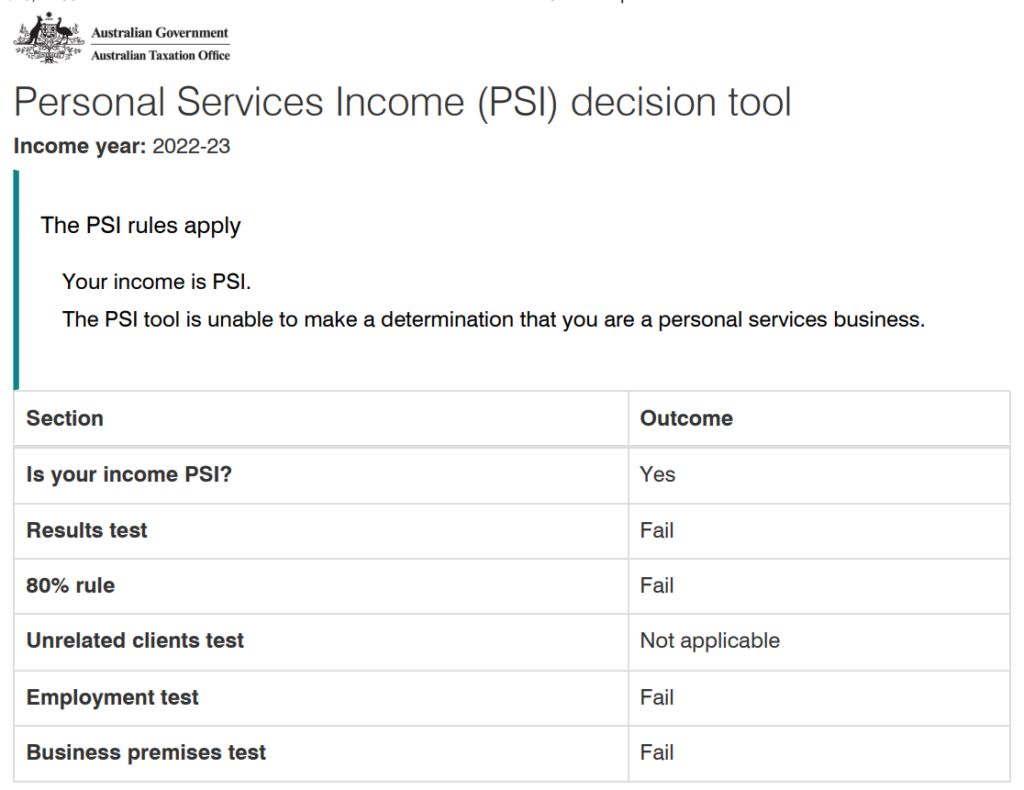

The ATO have a range of tools and calculators to help assess your PSI, and the ‘decision tool’ output will provide a pdf that you can save as evidence for your Income Tax filing.

For example, I was on a Time and Materials contract for a single client providing engineering consultancy in 2022/23, and (unfortunately) all of the income was classified as PSI.

Implications of PSI

Understanding PSI is crucial due to its implications on taxation and business structures. When income is classified as PSI, certain rules and restrictions come into play.

Attribution Rules

The ATO employs attribution rules to allocate the PSI appropriately. These rules consider factors such as equipment usage, location of work, and the entity through which the services are provided. It’s essential for individuals to be aware of these rules to ensure accurate reporting.

Personal Services Business (PSB) Tests

To mitigate the effects of PSI rules, individuals can qualify as a Personal Services Business by meeting specific tests. These tests assess factors like the level of independence, business premises, and the ability to delegate tasks. Successfully passing these tests allows for more favorable tax treatment.

Managing PSI for Indivduals

For individuals operating within the PSI framework, adopting effective strategies is paramount.

1 Business Structure Considerations

Choosing the right business structure is crucial. While a sole trader or partnership may be suitable for some, others might benefit from establishing a company. Each structure comes with its own set of advantages and considerations, and the choice should align with the nature of the services provided.

2 Record-Keeping and Documentation

Accurate record-keeping is vital for individuals managing PSI. This includes detailed invoices, receipts, and documentation demonstrating the contractual nature of the services provided. Maintaining a clear paper trail is essential for compliance and potential audits.

PSI in Different Professions

PSI impacts various professions differently. Freelancers, consultants, and professionals in the creative industries may find PSI rules particularly relevant to their work. It’s essential for individuals in these fields to be well-versed in the specific nuances that apply to their line of work.

Conclusion

Navigating the realm of Personal Services Income in Australia requires a nuanced understanding of tax regulations, business structures, and compliance measures.

This guide has provided an overview of the key aspects surrounding PSI, from its definition and identification to the implications for individuals and strategies for effective management.

Staying informed and seeking professional advice are crucial steps in ensuring compliance and optimizing financial outcomes in the dynamic landscape of personal services income in Australia.